At a time when the global share of power batteries is gradually declining, Japan once hoped to stage a "comeback" in the next-generation solid-state batteries and made huge investments in them. However, China is now accelerating its efforts to catch up.

According to data from PatSnap, as of May 16, 2025, the number of patent applications in the global solid-state battery field has exceeded 46,000. Among them, in terms of technology sources (the countries where the patent application enterprises belong), nearly 37% of the patent applications in the global solid-state battery field come from Japan, and nearly 30% come from China, further narrowing the gap between the two. In terms of market layout (the country where patent applications are made), China has surpassed Japan and become the market with the largest number of solid-state battery patent layouts globally, accounting for approximately 35%.

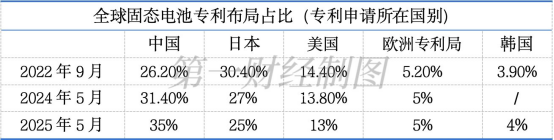

Journalists have tracked the patent application data in the global solid-state battery field from September 2022 to the present and found that China has accelerated its layout in the solid-state battery field in the past three years. The gap between Chinese enterprises and Japan in the number of patent applications has been continuously narrowing. However, in terms of leading companies, Japan still has a relatively obvious advantage.

The dispute over solid-state batteries between China and Japan

As one of the earliest countries to lay out batteries, Japan had the first-generation "Big Three" composed of Panasonic, Sanyo and SONY as early as the 1990s. By the early 21st century, Japanese enterprises had produced nearly 90% of the world's lithium batteries, almost forming a monopoly.

The turning point originated from this round of "expansion wave" of power batteries after 2010. Around 2010, Japanese automotive giants led by Toyota firmly believed that hydrogen fuel cell vehicles were the future. This concept has led the Japanese battery industry chain to bet on hydrogen fuel cells while neglecting the investment in lithium-ion power batteries. On the contrary, with the strong promotion of policies and the support of a huge market, the development of new energy vehicles in China is in full swing, which also leads battery enterprises to make great strides forward.

Data from SNE Research, a South Korean battery and energy research company, shows that in 2024, the top ten global power battery sales were still dominated by enterprises from China, South Korea, and Japan. Among them, six Chinese enterprises made the list, and the market share of these six Chinese battery manufacturers in the global market further rose to 67.1%. Among the top ten Japanese battery manufacturers, only Panasonic made the list, with its market share dropping from 6.1% in 2023 to 3.9% in 2024.

If Japan wants to stage a comeback, it has to look at the next-generation battery technology. A senior executive of a start-up solid-state battery company once told a reporter.

Solid-state batteries are widely recognized in the industry as the next-generation battery technology, and Japan was once the country that made the largest investment in this regard. According to PatSnap data, as of September 2022, nearly 45% of global patent applications in the solid-state battery field were from Japanese enterprises, while the figure for Chinese enterprises was 21.8% at that time, showing a relatively significant gap.

Since then, Chinese enterprises have been catching up, while accordingly, the proportion of Japanese enterprises' patent applications for solid-state batteries has been continuously declining. As of May 2025, in the global patent applications for solid-state batteries, the share of Japanese enterprises has dropped to nearly 37%, while that of Chinese enterprises has risen to nearly 30%.

From the perspective of the location of patent applications, as of September 2022, Japan was the country with the largest patent layout for solid-state batteries globally, accounting for approximately 30.4%, while China accounted for about 26.2%. This situation was reversed in 2024. As of May 2024, China was the market with the largest number of solid-state battery patent layouts globally, accounting for approximately 31.4%, while Japan accounted for about 27%. As of May 2025, the gap between China and Japan has further widened. China's patent layout for solid-state batteries accounts for approximately 35%, while Japan's accounts for about 25%.

Apart from the competition between China and Japan over solid-state batteries, another point worth noting is that, unlike the current "three-way battle" market pattern of power batteries among China, Japan and South Korea, South Korea has fallen behind in the patent layout of solid-state batteries, with China, Japan and the United States taking the top three spots.

The "ambition" of the United States in solid-state batteries cannot be ignored. As of May 2025, US enterprises accounted for approximately 11% of global patent applications in the solid-state battery field, and the proportion of global solid-state battery patent layout from the US market was 13%. Both of these figures in the United States rank after those of China and Japan, ranking third in the global market.

Leading enterprises in Japan still have obvious advantages

From the perspective of the patent application situation of solid-state batteries by specific power battery enterprises, although Chinese enterprises are catching up rapidly, the leading Japanese enterprises still have a significant leading advantage at present.

In terms of patent applications for solid-state batteries, leading Chinese enterprises include CATL, BYD, SVOLT Energy Technology, Qingtao Energy, and Guoxuan High-Tech, among others.

According to PatSnap data, as of May 16th, CATL and its affiliated companies have a total of over 170 patent applications in the field of solid-state batteries, among which more than 40 are authorized invention patents. Byd and its affiliated companies currently have over 90 patent applications in the field of solid-state batteries, among which more than 40 are authorized invention patents. Guoxuan High-Tech and its affiliated companies currently have over 120 patent applications in the field of solid-state batteries, among which more than 20 are authorized invention patents. Svolt Energy and its affiliated companies currently have over 150 patent applications in the field of solid-state batteries, among which more than 60 are authorized invention patents.

In terms of the layout of solid-state batteries, the leading Japanese enterprises include Panasonic, Nissan, Toyota and Honda. Among them, Toyota is the absolute leading enterprise in this field.

As of May 16th, Toyota and its affiliated companies have a total of over 2,100 patent applications in the field of solid-state batteries, among which over 1,200 are authorized invention patents. Panasonic and its affiliated companies currently have over 910 patent applications in the field of solid-state batteries, among which more than 330 are authorized invention patents. Nissan and its affiliated companies currently have over 420 patent applications in the field of solid-state batteries, among which more than 200 are authorized invention patents. Honda and its affiliated companies currently have over 290 patent applications in the field of solid-state batteries, among which 110 are authorized invention patents.

In terms of the terminal application of all-solid-state batteries, China and Japan are also taking the lead in the implementation time.

In February this year, Sun Huajun, the CTO of BYD Lithium Battery Co., LTD., stated that BYD will start the batch demonstration and application of all-solid-state batteries in vehicles around 2027 and achieve large-scale vehicle installation after 2030. Gac Group announced its plan to achieve vehicle installation by 2026. Changan Automobile plans to achieve the first launch of a fully solid-state functional prototype vehicle in 2025, complete vehicle installation verification in 2026, and gradually advance mass production in 2027. Jia Jianxu, the president of SAIC Motor, disclosed that in 2027, SAIC's first all-solid-state battery, the "Guangqi Battery", will be launched.

Among the three major Japanese automakers, Toyota plans to achieve small-scale mass production of all-solid-state batteries by 2025 and stable mass production of all-solid-state batteries by 2030. Nissan plans to establish and operate a pilot production plant for all-solid-state batteries in 2025, and apply them to automobiles for the first time in 2028, gradually achieving mass production. Last November, Honda Motor announced that it would start trial production of all-solid-state batteries in January 2025. It is expected that Honda's solid-state batteries will be mass-produced and used in vehicles before 2030.